Personal Loans copyright for Beginners

Personal Loans copyright for Beginners

Blog Article

Rumored Buzz on Personal Loans copyright

Table of ContentsOur Personal Loans copyright IdeasPersonal Loans copyright Fundamentals Explained10 Simple Techniques For Personal Loans copyrightFacts About Personal Loans copyright UncoveredSome Of Personal Loans copyright

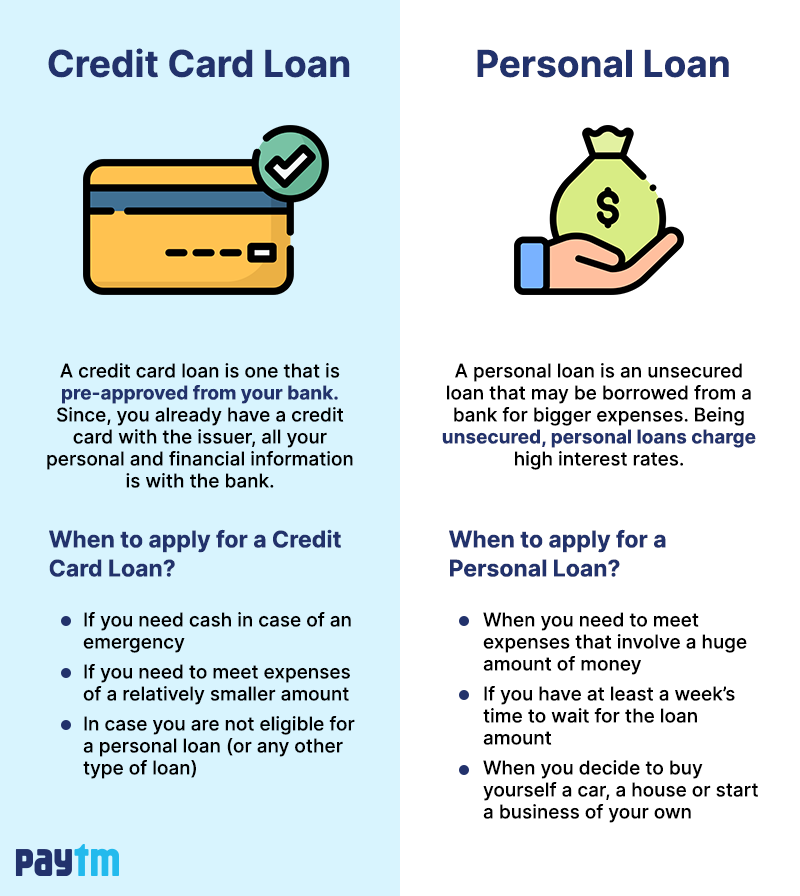

Let's study what an individual finance really is (and what it's not), the reasons people use them, and how you can cover those insane emergency expenditures without handling the worry of debt. A personal car loan is a swelling sum of cash you can borrow for. well, practically anything., yet that's practically not an individual funding (Personal Loans copyright). Individual finances are made via an actual economic institutionlike a financial institution, credit rating union or on-line loan provider.

Let's take a look at each so you can know precisely just how they workand why you do not need one. Ever before.

What Does Personal Loans copyright Mean?

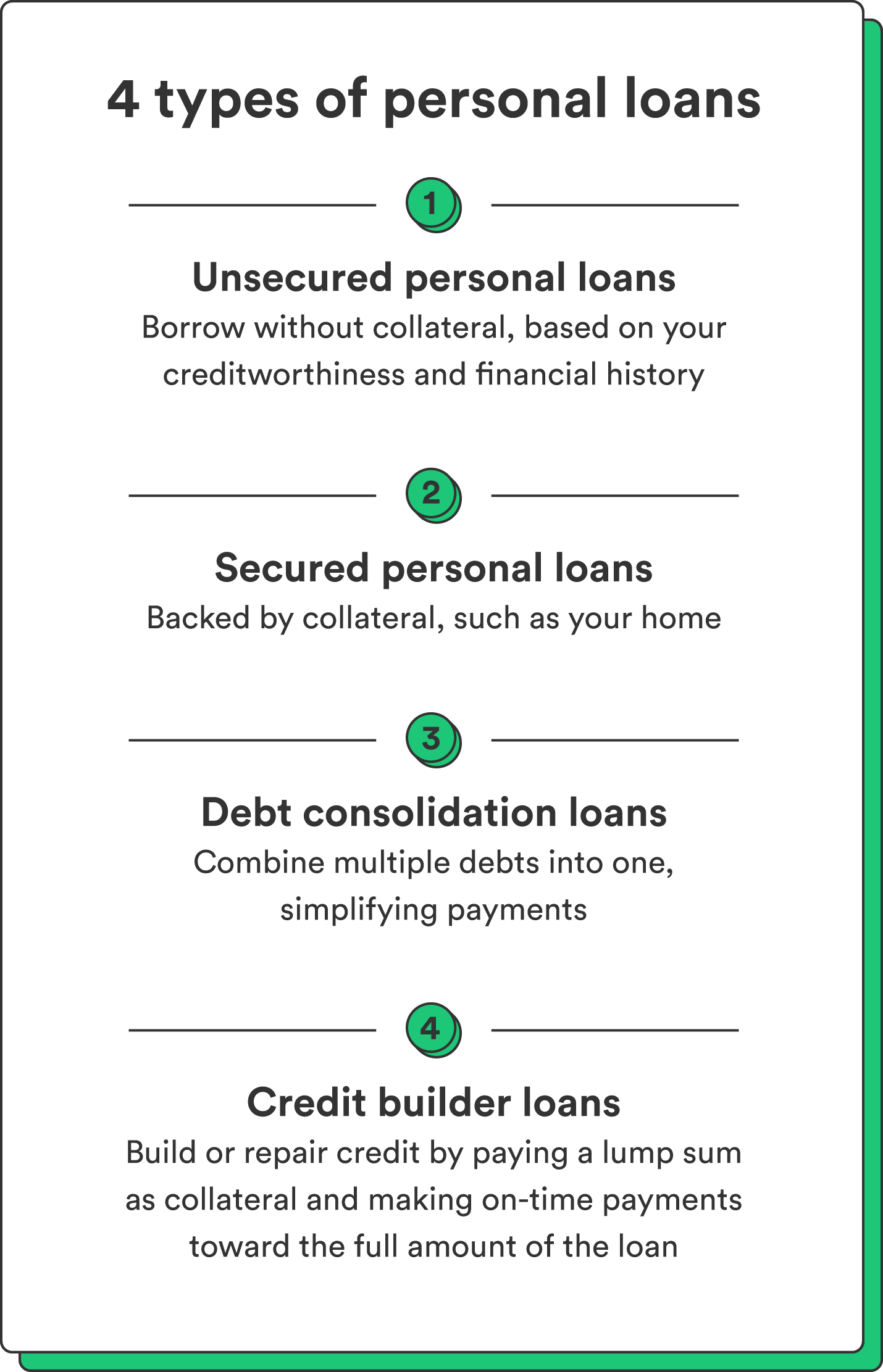

Stunned? That's all right. No matter exactly how good your credit report is, you'll still have to pay passion on many individual lendings. There's always a cost to spend for borrowing money. Guaranteed individual finances, on the various other hand, have some type of security to "safeguard" the financing, like a watercraft, fashion jewelry or RVjust among others.

You could also take out a safeguarded individual loan utilizing your vehicle as collateral. That's an unsafe move! You don't desire your main setting of transportation to and from work obtaining repo'ed due to the fact that you're still spending for in 2014's cooking area remodel. Count on us, there's absolutely nothing safe concerning safe lendings.

Simply since the repayments are predictable, it doesn't mean this is a great offer. Personal Loans copyright. Like we stated previously, you're pretty much ensured to pay rate of interest on a personal funding. Simply do the mathematics: You'll wind up paying method more in the future by taking out a finance than if you would certainly just paid with cash

Personal Loans copyright for Dummies

And you're the fish hanging on a line. An installation funding is a personal lending you repay in dealt with installments gradually (generally once a month) up until it's paid in complete - Personal Loans copyright. And don't miss this: You need to pay back the original finance quantity prior to you can obtain anything else

Don't be mistaken: This isn't the same as a credit card. With personal lines of credit scores, you're paying interest on the loaneven if you pay on time.

This one gets us provoked up. Due to the look here fact that these businesses prey on people that can't pay their expenses. Technically, these are short-term car loans that give you your paycheck in breakthrough.

Indicators on Personal Loans copyright You Should Know

Why? Due to the fact that things get real her explanation messy actual quick when you miss out on a settlement. Those financial institutions will certainly come after your pleasant grandmother that guaranteed the loan for you. Oh, and you must never ever guarantee a funding for anybody else either! Not only can you obtain stuck with a funding that was never ever indicated to be yours to begin with, however it'll mess up the connection before you can state "compensate." Trust us, you don't want to be on either side of this sticky situation.

All you're truly doing is making use of brand-new financial obligation to pay off old debt (and extending your lending term). That simply means you'll be paying also much more over time. Companies know that toowhich is exactly why so numerous of them supply you combination finances. A reduced rates of interest doesn't get you out of debtyou do.

And it starts with not obtaining any type of more cash. ever before. This is a good regulation of thumb for any type of financial purchase. Whether you're believing of getting a personal funding to cover that cooking area remodel or your overwhelming bank card expenses. don't. Securing financial obligation to spend for points isn't the way to go.

The smart Trick of Personal Loans copyright That Nobody is Talking About

And if you're thinking about an individual loan to cover an emergency situation, we my response get it. Borrowing money to pay for an emergency only intensifies the stress and anxiety and challenge of the scenario.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

Report this page